Pollstar: How Live Nation’s Russell Wallach Has Taken Branding In Live To New Heights

This article originally appeared on Pollstar as a part of its first-ever branding special.

For the past 20 years, Russell Wallach, Global President, Live Nation Media & Sponsorship, has seen his division grow exponentially. So much so, that it’s the second largest revenue driver for Live Nation, which in the global promoter’s 2024 earnings report put Sponsorship and Advertising revenues to nearly $1.2 billion, a hundred million dollars more than 2023.

Wallach and his team of 700 can take much of the credit for that success as they continue pushing boundaries of what’s possible in the space. This includes more global territories and international branding deals, building out in-house creative, insights and influencer teams, developing new deals that give the promoter equity in brands like Liquid Death and wildly creative activations like Charmin’s VIPee bathrooms in GA or a Coca-Cola skating rink at Lollapalooza that push the envelope of what’s possible.

Here, Pollstar caught up with Wallach to learn more about his work, his career tentpoles, and what lies ahead for branding.

Pollstar: When you started at Live Nation 20 years ago, the branding space in the live music was nascent. In macro terms, can you describe how branding in the live industry, which you helped create, has changed?

Russell Wallach: The type of branding we’re seeing today didn’t exist in music 20-25 years ago. It existed in sports, but didn’t exist in music in a real big way. That was the big opportunity. Michael Rapino saw that because he started in the brand world and understood this.

He was at Labatt beer, right?

Yes, exactly. It really kicked off in a big way when we launched Live Nation 20 years ago, that was the first time we had our own brand to go to market with. We looked at it similarly to the NFL, NBA or MLB. We now have a global brand that partners can be an official partner with, similar to how they are in sports. There used to be individual promoters, so it was harder for brands to work on things from a national or global standpoint. There aren’t a tremendous amount of global properties in sports or music, so our ability to provide brands a platform globally has been incredible in meeting the needs of a wide range of brands.

When you started, how many people did you oversee?

It was a small team, and some of the team is still here with me today. There were probably under 20 of us. In 2025, we were over 700 people.

Basically you started a company within a company. What were some of the tentpoles as the department grew?

The idea of having a national platform we could go to a brand and say, “We can now work with you across 30 or 40 different major cities across the country” versus just maybe in New York or Chicago was a major change. Another tentpole was our partnership with C3 (Presents) in 2014. We now had a major festival platform in the U.S., which we didn’t have prior to that. Another big moment for our business, and me personally, was in 2021, our deal with Liquid Death. It was the first time we became an equity partner with a brand. Instead of a traditional sponsorship deal, we saw a company that had a similar mission to ours around sustainability and was an interesting, fun and different type of brand. We decided to become an investor and partner and help it grow while meeting the needs of fans. That was a big a-ha moment. Michael and I worked on that together. It’s been a tremendous partnership.

Are more equity brand partnerships coming?

We have an ice cream brand CVT Soft Serve we sell at our amphitheaters. It’s fantastic. We have a charging company FUZE Technology to charge phones at venues and festivals. There’s a new beverage we’re getting ready to announce with a major artist very soon.

The creativity of some of your initiatives is amazing. How did you start your own in-house creative team?

We started with less than 20 people, we had a lot of generalists and people doing a lot of different things. Fast forward and we’ve got 700 plus people around the world, over 400 in the U.S., with experts in all key areas. We have an entire in-house creative team coming up with incredible ideas; an in-house experiential team that’s the best in the business; an insights team with some of the best people from the NFL and other great insights firms able to get deep insights on our fans. We have a tech innovation team that’s coming up with new ideas. We have our own influencer platform and partnerships with Snapchat and TikTok.

Could your team ever be outsourced for deals outside of Live Nation?

Brands that have asked us to activate for them at non-Live Nation events and for certain strategic partners, we’ll do that, but it’s not a core of what we do, but the skillset and the capability is absolutely there.

What were some of your global tentpole initiatives?

Coca-Cola worked with us at Lollapalooza in multiple territories around the world. Anheuser-Busch is working with us on a number of brands at Lollapaloozas around the world. We’ve been able to take a brand like Lollapalooza from Chicago to South America to Berlin to Paris and now to India and bring sponsors along. There’s a number of brands that we’ll be announcing in the next month looking at global initiatives. Liquid I.V., a brand that started with us in the U.S., is now in seven countries at different festivals. Bacardi works with us in multiple territories. Our partnership with MasterCard is now in over 20 countries.

How involved are you in tour sponsorships?

A lot is related to artists interested in pre-sale programs. Recently MasterCard worked with Lady Gaga across international markets. Citi and Verizon worked with Lady Gaga in the U.S. Our deal with Bud Light and Dirks Bentley is a tour related program. In some cases, it works on a regional basis. A lot of tour sponsorships come from managers and agents, who do a great job and that’s a part of the mix.

How has data and metrics in branding changed?

It’s had to get more sophisticated because brands have a lot of different ways to spend their money. We want to be as sophisticated as we can in terms of measuring the results of a program. There’s parts that happen on the front end as we’re going through the presentation and deal process. We have something called Soundboard, basically a focus group of 10,000 global music fans. When we’re about to work with a brand, we can talk to our fans, get their brand perceptions and then we can build the best possible program for them. What we’re then doing, which is getting more sophisticated between us and brands, is lasering in on what they want to evaluate. If you’re an airline or hotel, your metrics are different than if you’re a beverage or a beauty brand. That’s why we have experts from different industries within our team to understand those different nuances. Some fans or brands are looking for engagement or brand perception, some are trying to drive purchases or loyalty and want a certain number of downloads of their app or want to get a number of signups or looking for exposure, so they are looking at things like impressions. So if it’s up on the stage, how many impressions can I get from influencers in my activation area? It really varies. We also have teams doing surveys, talking to fans on site, measuring as much as we can so we can give the brands the information they need to continue to improve. We’re able to get feedback in real time and can make tweaks to their activation or other aspects.

So a lot of your initiatives go on for months or years rather than just one moment or event, right?

That’s exactly right. It’s not just about the 100,000 people on site; it’s about this six-to-nine month window. From the time the show, event or festival gets announced to when it happens, the brands are part of that journey. We call it the fan journey and that entire six to nine months can be letting the fans know what’s going to be happening on site. It could be about nearby hotels, taking an Uber, food and beverage or where they can get great outfits or makeup before the show. And it happens on site with influencers and social media like TikTok and Snapchat and you can now share that with tens of millions of people who aren’t there. Then festivals can be streamed and there’s also post-content. So the one weekend is a culmination. It’s the same thing with our venues. It’s a season just like the Yankees or Knicks, from May through September or October the music season is in amphitheaters with things happening every day with more shows and more excitement.

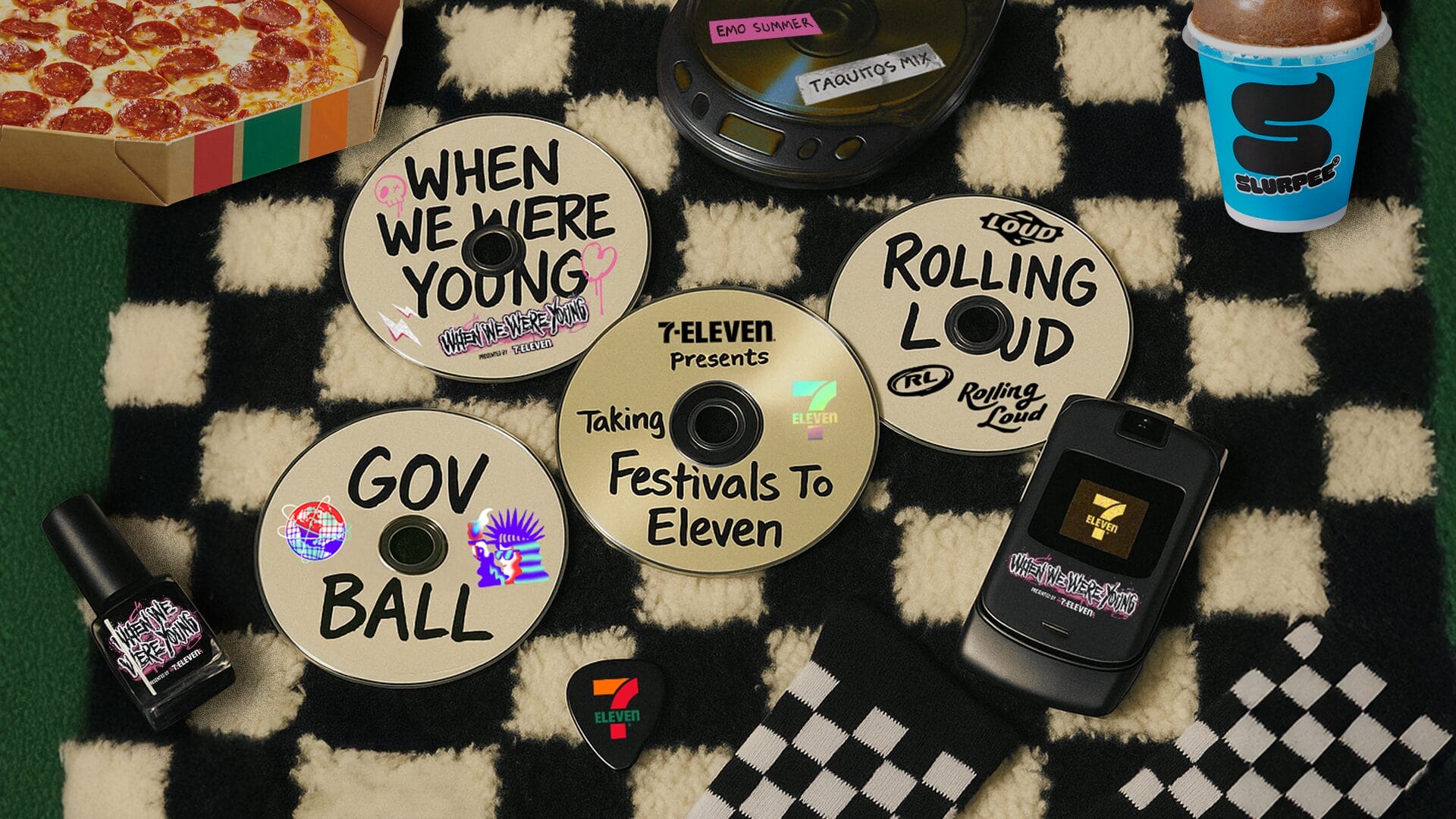

Tell me about this new 7-Eleven When We Were Young festival naming deal. That’s something we haven’t seen before.

That’s an example of an incredible partnership, working with the 7-Eleven team over the last six months on some really big ideas and kicking-off a multi year partnership with them and becoming the main partner of When We Were Young, which is something we haven’t seen here in the U.S. It’s something we do a lot in Mexico with Coca-Cola and Corona, we do in the UK with Rockstar. It’s just an incredible brand and we’ve seen so much excitement. All of our research with our fans told us that they just absolutely love the idea of 7-Eleven being on site. Everybody loves a Slurpee. It’s fun, different and the 7-Eleven team is truly amazing.

Going forward do we expect that this is going to be a new growth area with festival naming rights?

Absolutely brands, understand the value of these events. This is a new area for music. Look, sports has been doing it for a while with brands on jerseys, naming stadiums forever and major sporting events have brands on them. So this says that music is at that same level and brands need to be thinking about it from that perspective. So it’s really exciting.

What trends lie ahead for branding and live?

More and more international business, continued growth in Europe, APAC, Mexico, South America, we’ll continue seeing tremendous growth opportunities with new venues we develop. Taking a lot of the products, whether it’s influencers or partnerships we have in social media, insights teams and exporting that to territories around the world to use in local markets. Continued growth with festivals and venues around the world. You’re going to see more global brands in more markets. We’re going to start seeing more international brands, brands from Asia and Europe, doing more things in the U.S.